Medium-Term Management Plan

- Medium-Term Management Plan 2025

- Summary of 10 years of holdings system transition

- Summary of past medium-term management plan

| Announced May 9, 2023 |

|---|

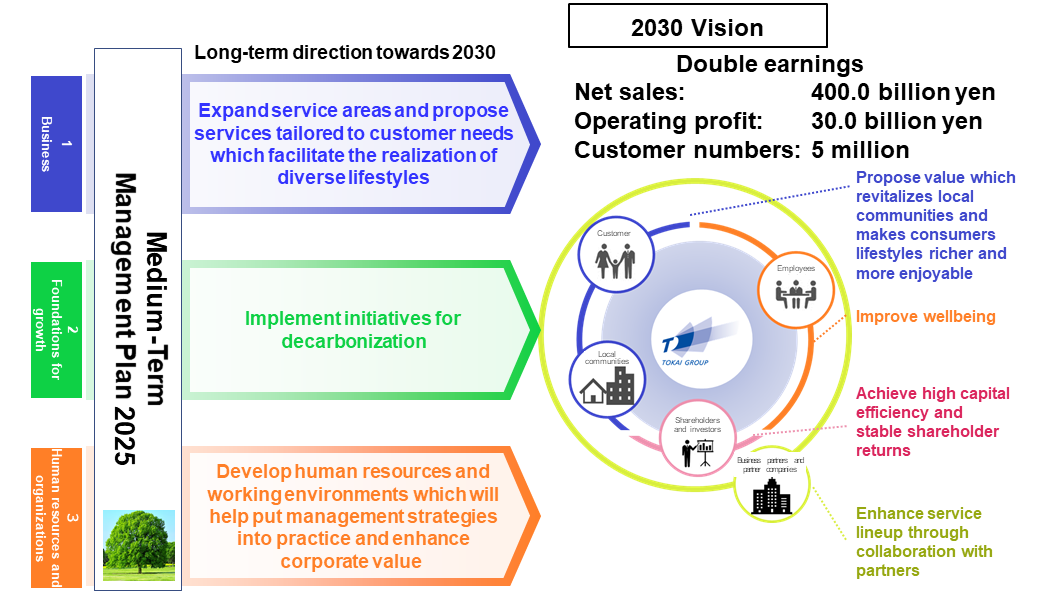

- 2030 Vision

- Initiatives for 3-Year Period (Key Themes)

- Core strategy (1)Growth of business earning power

- Core strategy (2)Strengthen the foundations for sustainable growth

- Core Strategy (3)Full energization of human capital and organizations

- KPIs under Medium-Term Management Plan

- Management resources allocation policy and shareholder returns

2030 Vision

Our business activities are made possible by the support of our many stakeholders, including customers, shareholders, investors, the local community, business partners, and employees. We strive to provide value propositions that revitalize the local community and enable individuals to lead enriched lives. We also prioritize the well-being of our employees, who contribute to our business operations.

Furthermore, we aim to enhance business value and shareholder value in the long term by expanding our lineup through partner collaboration. We have set ambitious goals of doubling our profits, specifically achieving sales of 400 billion yen, operating profit of 30 billion yen, and a customer base of 5 million, and we strive for their early realization.

In our "Mid-Term Management Plan 2025," we are committed to steadily increasing our earnings as a company that responds to the expectations of our stakeholders in a changing market environment, working towards the envisioned state for 2030.

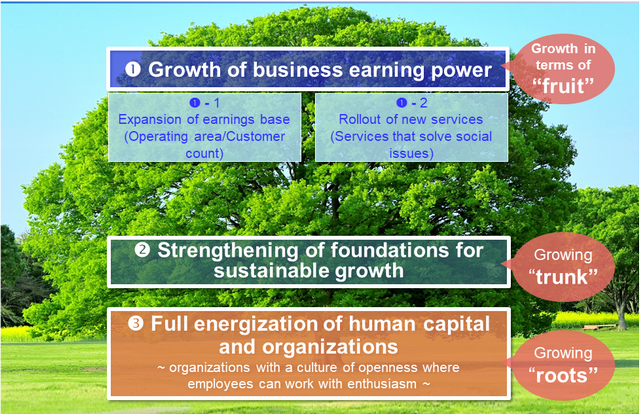

Initiatives for 3-Year Period (Key Themes)

Over the next three years until the fiscal year 2025, we will strengthen our efforts along the growth tree composed of three elements: "Roots of Growth," "Trunk of Growth," and "Fruits of Growth."

First, focusing on the ultimate goal, the "Fruits of Growth," we aim to achieve "business profitability growth" through expansion of the revenue foundation and the introduction of new services.

Additionally, we will work on strengthening the "Trunk" as the sustaining growth foundation. This involves intensifying efforts to achieve decarbonization and promoting sustainability within the TOKAI Group and the local community.

To support these endeavors in the medium to long term, we will focus on the "Roots of Growth" by maximizing the vitality of our human resources and organization. This includes expanding investments in human capital and creating an organization where employees can thrive and actively contribute, fostering an open and vibrant work environment.

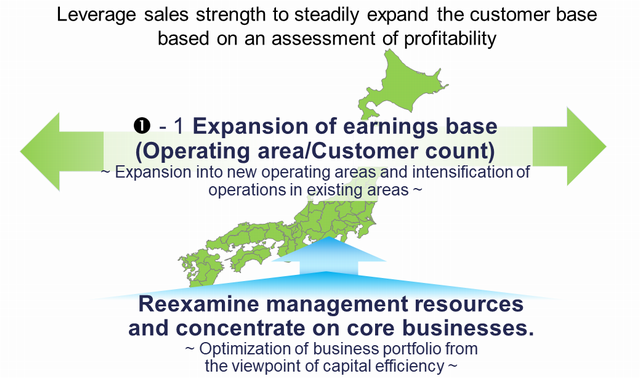

Core strategy (1)Growth of business earning power

We will conduct a reassessment of our company group's management resources and focus on our core business, optimizing our business portfolio from the perspective of capital efficiency.

Building on our sales capabilities, we will actively pursue new area expansions and increase density in existing areas, aiming to expand our revenue foundation.

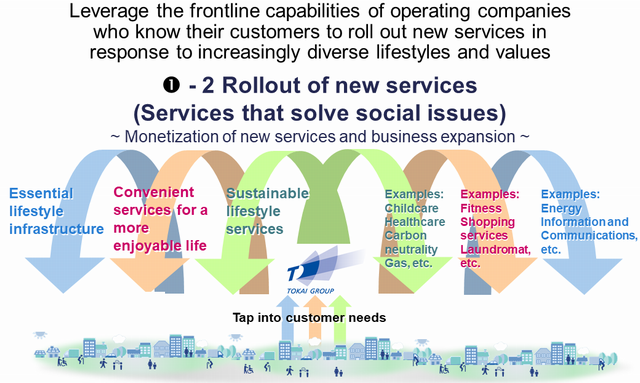

We will develop new services that cater to the diversifying lifestyles and values of our customers, with a focus on addressing social issues.

To achieve this, we will leverage the operational strength of our business companies closer to our customers. By capturing customer needs, we will further enhance our service lineup, including essential lifestyle infrastructure, services that enhance convenience and enjoyment in daily life, and sustainable living services.

For more detailed strategies for each segment, please seePDF

Core strategy (2)Strengthen the foundations for sustainable growth

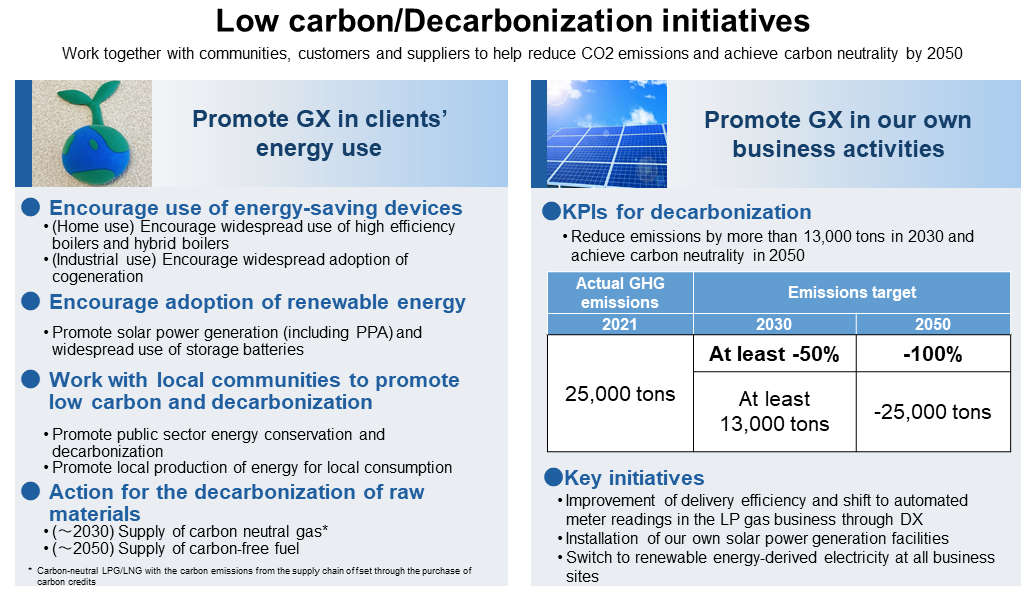

For the Group, which develops energy businesses such as LP gas and city gas, efforts to low and decarbonize are major themes in achieving sustainable growth.

We will work together not only with our group but also with regions, customers, suppliers, etc. to achieve low and decarbonization.

We will promote GX in customers' energy use by promoting the popularization of energy-saving equipment and promoting the introduction of renewable energy.

In addition, in our own business activities, we will reduce carbon dioxide emissions, which used to be 25,000 tons, by more than 50% by 2030 as sales increase in the future. By continuing these efforts, we will achieve carbon neutrality by fiscal 2050.

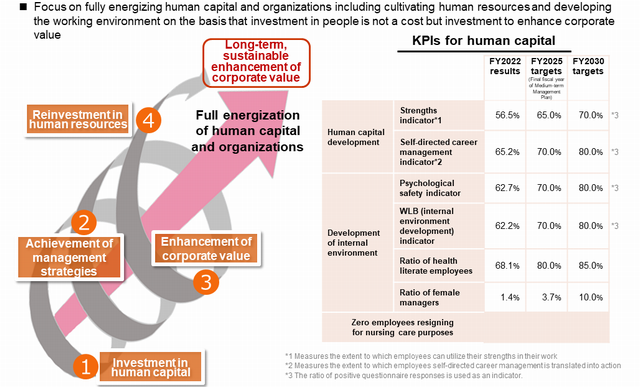

Core strategy (3)Full energization of human capital and organizations

The Group considers human resources as “capital” and invests in them to encourage employees to improve their skills and grow, and to maximize their vitality.

By increasing the profits of the company as a whole by allowing each individual to perform better than ever before, and by further investing those profits into human capital, we create a virtuous cycle in which employees and the company grow together.

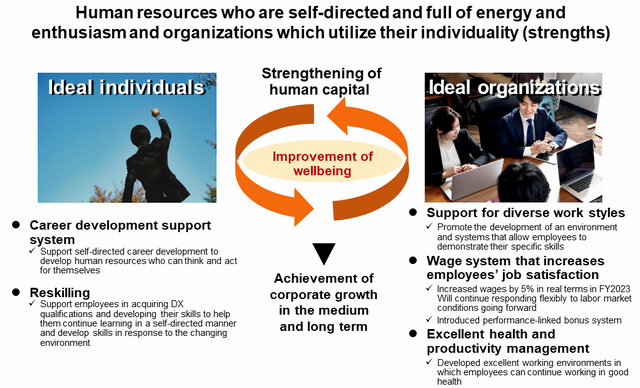

As a representative measure for improving well-being, we will revise the salary system to support ideal individuals, that is, “autonomous, energetic and enthusiastic human resources” and diverse work styles, and increase job satisfaction through career support systems and reskilling. In addition, we will realize an ideal organization, "an organization that makes the best use of individuality, where work is rewarding" through the practice of top-level health management.

The synergistic effect of these ideal individuals and ideal organization will improve well-being and lead to medium- to long-term corporate growth.

KPIs under Medium-Term Management Plan

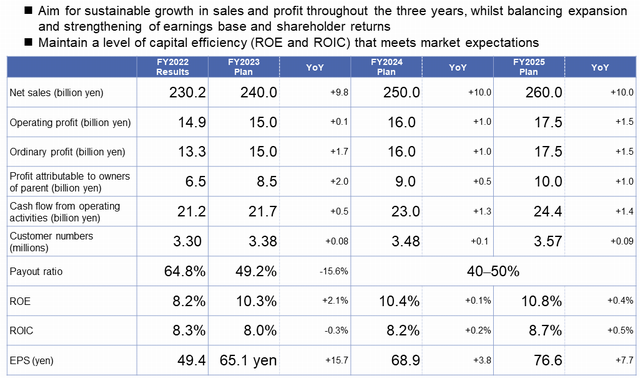

Aiming for sustainable increases in sales and profits over the next three years, we plan to achieve net sales of 260 billion yen, operating income of 17.5 billion yen, and net income of 10 billion yen in fiscal 2025.

Regarding management indicators, we will maintain the level of capital efficiency that meets market expectations, with ROE of 8.2% in FY2022 and 10.8% or more in FY2025, and ROIC of 8.3% in FY2022 and 8.7% in FY2025.

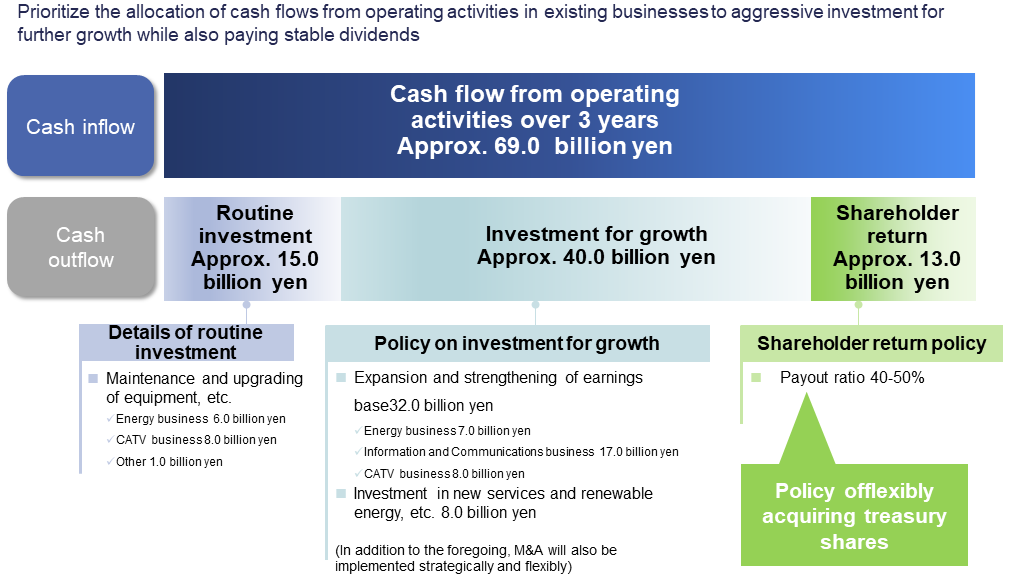

Management resources allocation policy and shareholder returns

We plan to allocate management resources totaling approximately 69 billion yen over the three-year period from cash flows generated from business earnings to regular investments, growth investments, and shareholder returns.

As for growth investment, we will invest 32 billion yen in "expansion and strengthening of the revenue base" and 8 billion yen in "investment in new services and renewable energy, etc.", for a total of around 40 billion yen.

As for shareholder returns, we plan to pay a total dividend of around 13 billion yen over the next three years, and our policy is to flexibly acquire treasury stock.

Through such optimal allocation of management resources, we aim to achieve future business growth and improve shareholder value.

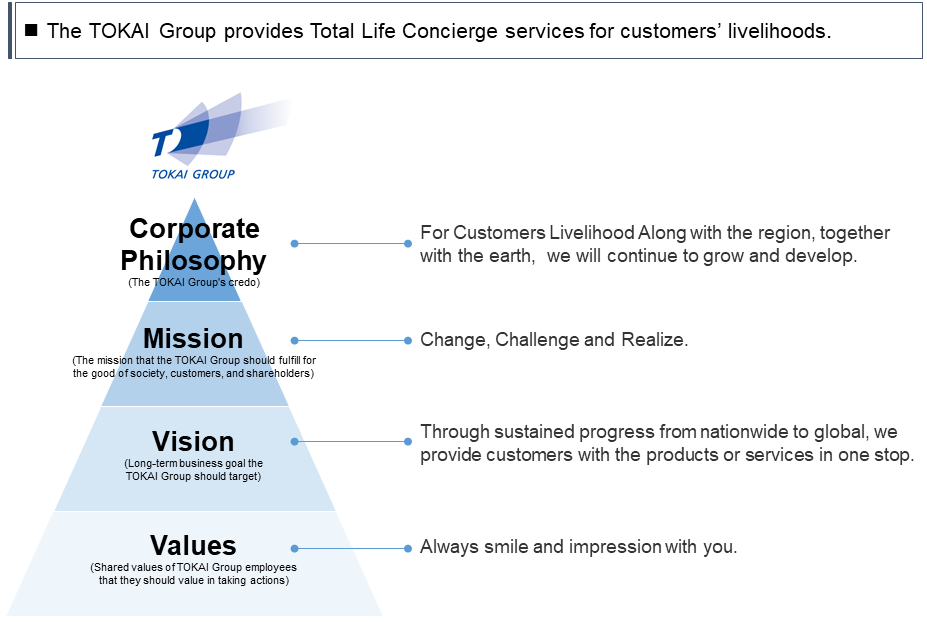

Corporate Philosophy of the TOKAI Group (TOKAI-WAY)

As shown in the TOKAI WAY, the TOKAI Group's philosophy is to provide comprehensive living services for the lives of our customers.

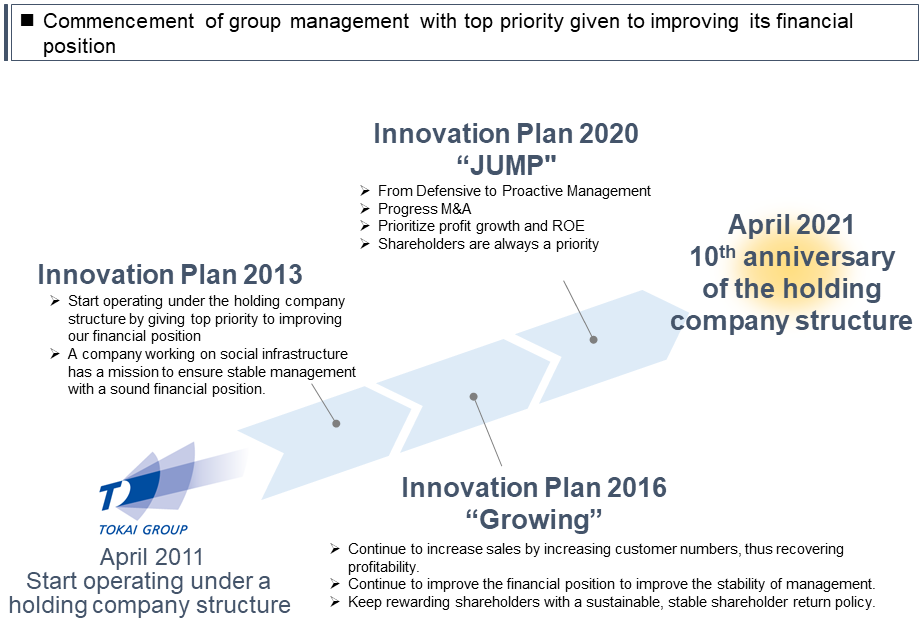

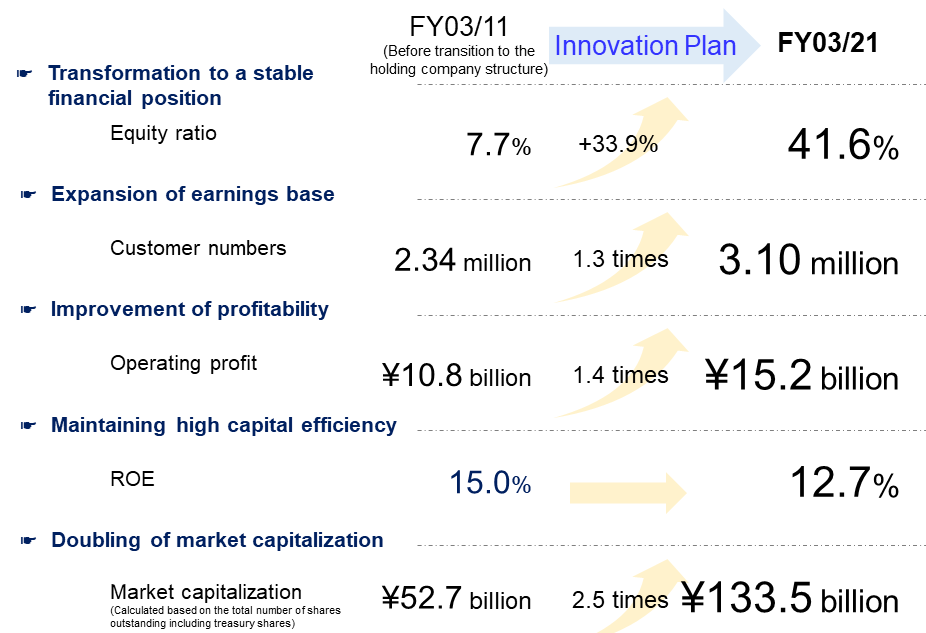

Start with top priority on improving financial position

Over the last 10 years, our financial position has improved significantly. With the establishment of the holdings system in April 2011, we turned to group management and started to give top priority to improving our financial position. Since then, we have been working to grow profits and enhance shareholder returns.

The equity ratio was 7.7%, which was overwhelmingly occupied by interest-bearing debt, but now it has improved to 41.6%. It can be said that the company has shifted to a stable financial position. The number of customers, which is the revenue base, has increased 1.3 times, and operating income, which is one of the profitability, has been strengthened 1.4 times. Capital efficiency remains at a high level of ROE of 12.7%. As a result, the market capitalization has doubled to about 2.5 times.

| Announced May 9, 2021 | |

|---|---|

| Announced May 9, 2017 | |

| Announced on June 27, 2014 |

* Partially revised as of July 14, 2014 |

| Announced May 10, 2011 |

- Medium-term management plan「Innovation Plan2024 "Design the Future Life"」Summary

- Medium-term management plan「Innovation Plan2020 "JUMP"」Summary

- Medium-term management plan「Innovation Plan2016 "Growing"」Summary

- Medium-term management plan「Innovation Plan2013」Summary

Medium-term management plan「Innovation Plan2024 "Design the Future Life"」

■Summary of FY2022

- Sales increased for the sixth consecutive year. The number of customers will increase by more than 100,000 from the end of fiscal 2021 to 3.3 million

- Excluding the equity method investment loss in Vietnam, etc., capital efficiency maintains a level that meets the expectations of the stock market

- Energy, CATV, and Aqua recorded higher profits due to an increase in the number of customers, and corporate information and communications also performed well

- The main reason for the decline in energy profit is the impact of soaring gas purchase costs (partially due to price pass-through, prioritizing competitiveness)

- Although the number of customers acquired in personal information and communications greatly exceeded the previous fiscal year, acquisition costs increased

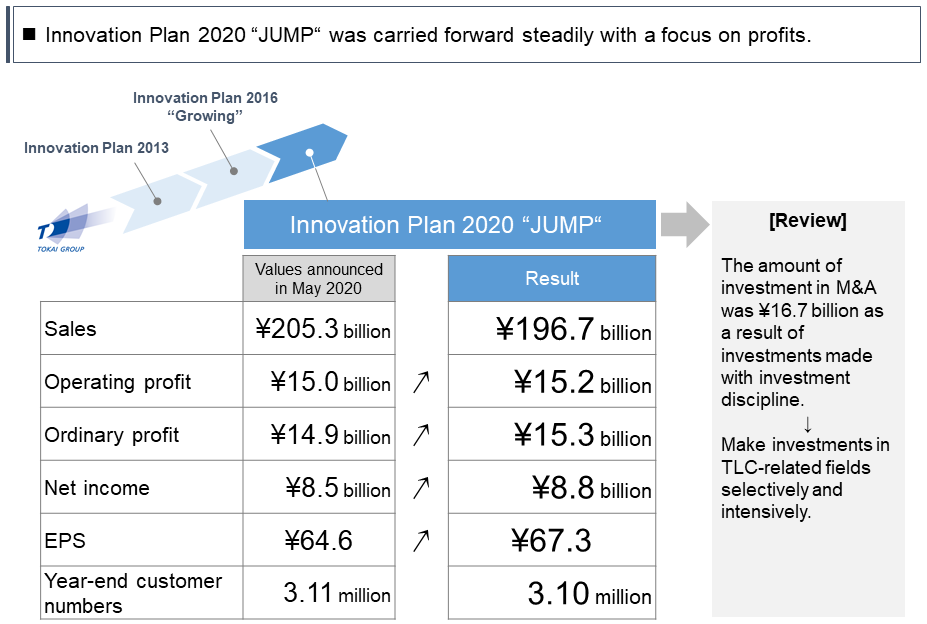

Medium-term management plan「Innovation Plan2020 "JUMP"」

The Innovation Plan 2020 “JUMP” has set challenging goals to give momentum to further growth. We have achieved the plan announced in May 2020, focusing on profits, and believe that we have made steady progress.

Medium-term management plan「Innovation Plan2016 "Growing"」Summary

- Theme

- ●Continue to increase sales by accumulating the number of customers and recover profitability

●Continue to improve our financial position and raise management stability

●Reward shareholders with a continuous and stable return policy

Performance of major management indicators

| Innovation Plan2013 |

Innovation Plan2016 “Growing” | ||||

|---|---|---|---|---|---|

| 2011/3 Result |

2014/3 Result |

2015/3 Result |

2016/3 Result |

2017/3 Result |

|

| Number of customers (thousands) | 2,340 | 2,520 | 2,537 | 2,558 | 2,564 |

| Sales (billion yen) | 174.9 | 189.0 | 187.5 | 180.9 | 178.6 |

| Operating income (billion yen) | 10.8 | 7.4 | 9.0 | 8.2 | 12.8 |

| Earnings per share (Yen / share) |

30.48 | 22.67 | 34.16 | 30.01 | 64.46 |

| EBITDA(billion yen) | 26.3 | 24.9 | 26.2 | 25.0 | 28.4 |

| Interest-bearing debt (billion yen) | 124.0 | 85.8 | 73.1 | 71.4 | 54.1 |

| Capital adequacy ratio(%) | 7.7 | 21.6 | 25.7 | 25.6 | 34.5 |

Main initiatives of major businesses

| Business division | Main initiatives |

|---|---|

| LP gas business | Information sharing of retail business (gas, aqua, information, security, remodeling, insurance) is used to acquire new customers. Expand the customer base centering on highly profitable detached houses. |

| City gas business | Actively develop fuel cells (ENE-FARM) for household demand. Promote a cogeneration system for industrial demand. Also for steam, hot water, and power supply. |

| Aqua business | Expand customer target by launching new product "Sarari". Expand sales through sales channels centered on large commercial facilities with high ability to attract customers. |

| Broadband business | Efficiently acquire customers by concentrating sales teams on stores with high acquisition efficiency in the sales channels of 230 major consumer electronics mass retailers nationwide. |

| CATV business | Expand new broadcasting customers with a collective bulk broadcasting basic free plan + additional services. Expanded telecommunications customers by leveraging alliances with mobile phone carriers (smartphone discount). Furthermore, it has penetrated the region by improving service value such as 4K / 8K, broadcasting light, and regional wireless services. |

Medium-term management plan「Innovation Plan2013」Summary

Look back on the medium-term management plan "Innovation Plan 2013" that we have been working on from the fiscal year ending March 2012 to the fiscal year ending March 2014.

- Theme

- The holdings system started with the highest priority on improving the financial position

Our mission as a company responsible for social infrastructure is stable management with sound finances. - Result

- ●The financial condition has improved significantly. Expansion of shareholders' equity due to an increase in the number of individual shareholders.

●Although the number of customers increased, profits were squeezed due to increased costs due to competition for acquisition. Structural challenges.

Achievement status of major management indicators

| Capital adequacy ratio | Interest-bearing debt balance | Number of shareholders | Number of customers | Sales | Operating income | |

|---|---|---|---|---|---|---|

| FYE March 2011 | 7.7 % |

124.0 billion yen |

8,132 people |

2.34 million people |

174.9 billion yen |

10.8 billion yen |

| 13.9% Increase |

38.2bn Decrease |

36,458 people Increase |

180 thousad Increase |

14.1bn Increase |

3.4bn Decrease |

|

| FYE March 2014 | 21.6 % |

858 billion yen |

44,590 people |

2.52 million people |

189.0 billion yen |

7.4 billion yen |

| Progress | ◎ | ◎ | ◎ | ◎ | ○ | × |